Introduction and Rate of TDS

Section 194O was introduced by the Finance Act, 2020 (effective from 1st Oct 2020) to widen the tax net over digital commerce. It mandates e-commerce operators (‘ECO’) to deduct TDS at 1% of the gross amount of sales or service or both on payments to e-commerce participants.

TDS rate has been reduced from 1% to 0.1% w.e.f 01/10/2024. Thus, on or after 01/10/2024, TDS u/s 194O shall be deducted at 0.1% of gross amount of sales or services or both.

The deduction is made at earlier of the following: –

- At the time of crediting the party; or

- At the time of Payment.

Deemed Credit

Any payment made by a buyer directly to a seller in a transaction facilitated by ECO shall deemed to be credited or paid by the ECO to the e-commerce participant. Such amount would be included in the gross amount of sales or services for TDS deduction. Thus, even off-platform flows are captured for TDS.

Example 1: Marketplace Sale with Direct Bank Transfer

Scenario:

- A customer purchases a handmade lamp from Seller ‘A’ on an e-commerce platform CraftHub.in (ECO).

- Instead of paying through CraftHub’s payment gateway, the buyer calls Seller A (whose number is visible on the product page) and transfers ₹ 10,000 directly to Seller A’s bank account.

Implication u/s 194O:

- Although the payment is not received by ECO, the entire transaction was facilitated by the platform.

- Under 194O, this ₹10,000 is deemed to have been paid by the ECO to the Seller A.

- Hence, ECO i.e. CraftHub must include this ₹10,000 in the gross amount for TDS purpose and deduct TDS at 1% (0.1% w.e.f 01/10/2024).

Example 2: Restaurant Order via Food Aggregator

Scenario:

- A customer orders food via ZingEat, a food delivery app (ECO), from Spice Villa Restaurant.

- The app glitches, and the buyer calls the restaurant directly to place the order and pays ₹ 1,200 as cash on delivery.

Implication u/s 194O:

- The app facilitated the discovery of the restaurant and initiated the transaction.

- Even though payment was made offline, it is deemed as paid by ZingEat to Spice Villa.

- ZingEat must deduct TDS at 1% (0.1% w.e.f 01/10/2024).

Non-Applicability of TDS u/s 194O

No TDS if all of the following conditions satisfied: –

- E-commerce participant is individual or HUF;

- Gross amount of sale or service during the previous year is upto ₹ 5 lakhs;

- E-commerce participant have furnished PAN or Aadhar.

Legislative Intent and Context

Section 194O was part of a broader effort [alongside TCS under Section 206C(1H) and others] to ensure tax compliance in digital commerce. Prior to 2020, many small sellers on e-marketplaces fell outside the tax net or underreported income. By placing the onus on established platforms, the government aimed to improve reporting and widen the tax base. In essence, the law mirrors offline TDS (like 194Q on purchase of goods) to the online economy. Over time, authorities have sought to rationalize 194O: for example, the budget for FY 2024-25 cut the TDS rate from 1% to 0.1%, effective from 1/10/2024, to align the burden on online vs offline trade. The stated intent was parity with other thresholds [Section 194Q and Section 206C(1H), both carry 0.1%], thereby reducing compliance strain.

Important Points

- If PAN of e-commerce participant is not available then TDS shall be deducted at 5%.

- Section 194O applies only where the e-commerce participant is a resident of India. If the participant is a non-resident, 194O does not apply (instead, Section 195, equalisation levy or other provisions may govern)

- In case of a transaction to which both section 194O and 194Q (Purchase of goods more than ₹ 50 Lakhs) applies, TDS shall be deducted u/s 194O.

CBDT Clarifications

- 194O does not apply to sales executed on recognized stock exchanges (securities or commodity trades).

- 194O does not apply to e-auction activities such as sale facilitated by OLX. E-auctioneer merely facilitates price discovery on its portal, 194O does not apply since the sale itself is executed off-portal.

- Payment gateway will not be required to deduct TDS u/s 194O, if TDS have been deducted by ECO u/s 194O on the same transaction. E.g. Razorpay not required to deduct TDS u/s 194O if TDS have been deducted by ECO u/s 194O on the same transaction.

- After the first year, an insurance agent or aggregator with no active role in a policy sale need not deduct 194O on commissions earned – instead, the insurance company will deduct TDS on commissions u/s 194H in those subsequent years.

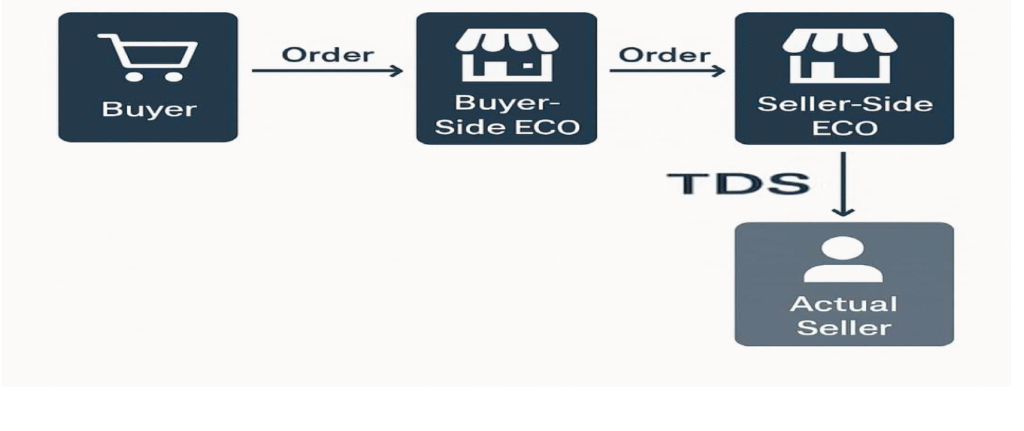

CBDT Guidelines on Open Network for Digital Commerce (ONDC)

If multiple ECO are involved in a transaction, the responsibility for section 194O compliance depends on whether the seller side ECO is the actual seller or not.

Situation 1: If the seller side ECO is not the actual seller, the compliance u/s 194O is to be done by the seller side ECO, who finally releases the payment to the actual seller.

Situation 2: If the seller side ECO is the actual seller, the compliance u/s 194O is to be done by the buyer side ECO, who finally releases the payment to the seller.

Judicial Interpretation – Significant Cases

There is limited case law directly on Sec. 194O, but notable trends are emerging:

- ITAT Mumbai – Riya Travel and Tours (India) Pvt. Ltd. [2025] 172 taxmann.com 652 (Mumbai – Trib.)[04-03-2025]: This recent case illustrates a narrow construction of “e-commerce operator.” Riya Travel, an airline ticketing agent, accessed a Computerized Reservation System (CRS) to issue tickets. The tax authorities contended that Riya was a 194O operator, since it “used” the CRS platform. The Tribunal disagreed. It held that Riya did not own, operate or manage the CRS – it merely subscribed as a user. The CRS owner and its Indian distributor controlled the software; Riya had no modification or distribution rights. Consequently, Riya was not liable to deduct TDS under 194O and could not be deemed as assessee in default.

No High Court or Supreme Court has yet pronounced judicial pronouncement on 194O, and no litigated disputes on issues like ONDC have reached judiciary as of this writing.

Implications for E-Commerce Businesses

For platform operators, Sec. 194O introduces significant compliance duties. ECO must:

- Deduct and deposit TDS on all eligible payments to sellers, at the prescribed rate upto 7th of next month.

- Include appropriate amounts in the TDS base: total invoiced sales prices plus any transaction-related charges billed to the buyer (shipping, handling, convenience fees, commissions)

- No TDS on GST Portion if separately mentioned on invoice.

- Issue TDS certificates (Form 16A) to sellers so they can claim credit.

- File quarterly TDS returns (Form 26Q) and an annual statement.

- Verify seller status and PAN: Collect and validate each seller’s PAN/Aadhaar. Deduct at 5% on any payment to a seller lacking valid PAN/Aadhaar.

- Track thresholds: For individual/HUF sellers, monitor annual gross receipts to apply the ₹5 lakh exemption.

Non-compliance

- ECO shall be treated as assessee in default u/s 201 and required to pay penalty u/s 221 that can be maximum of 100% of TDS amount.

- Late Deduction: Interest @1% per month or part of the month from the date on which TDS was deductible till the date on which TDS actually deducted.

- Late Payment: Interest @1.5% per month or part of the month from the date on which TDS actually deducted till the date on which such tax was actually paid.

Sources

- https://incometaxindia.gov.in/pages/acts/income-tax-act.aspx

- https://www.taxmann.com/

- CBDT circulars

- ICAI Study module

- Bhanwar Borana Sir Compact book