Can India become global hub of manufacturing for tech-based products? The answer is probably yes with India’s new ally in Income Tax Act- Section 44BBD.

Non-Resident service providers offering technologies or services to Indian companies may now choose a clear-cut presumptive taxation approach rather than traditional complex computations and claim based deductions.

Further, imposition of additional Tariff by the United States on China can create significant benefits for Indian manufacturing companies and section 44BBD may amplify those benefits.

This section may become the tax provision that drives India’s next wave of electronic growth. Whether you’re advising clients, managing compliance, or exploring opportunities in India’s tech ecosystem—this is a section you can’t afford to ignore.

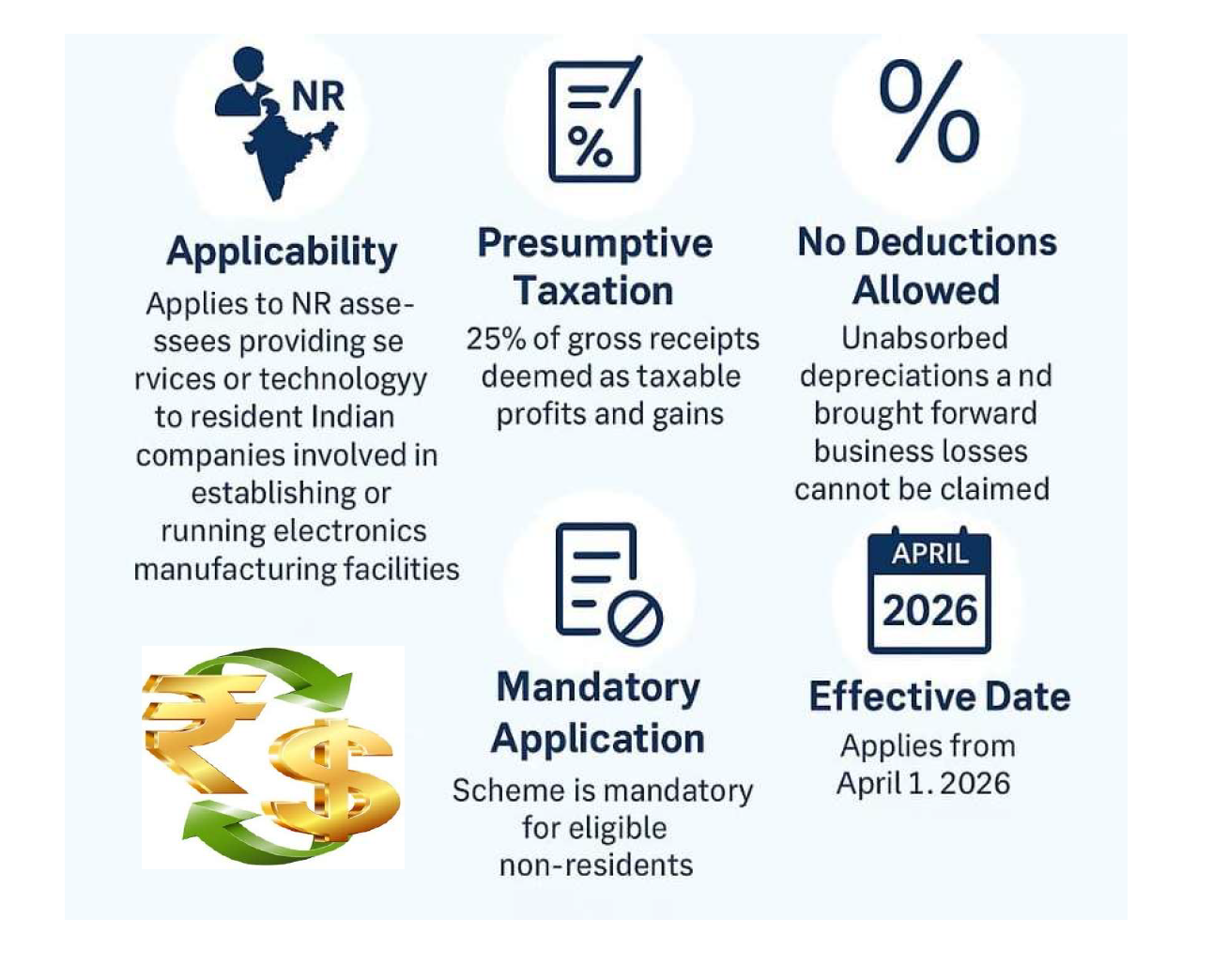

=> | Nature Of Business | Providing services or technology to resident Indian companies involved in establishing or running electronics manufacturing facilities under [government-notified schemes]1 |

=> | Assessee | Non-Resident |

=> | Presumptive Income (PGBP Income) | 25% of: – · the amount paid or payable to the non-resident · the amount received or deemed to be received by the non-resident on account of providing services or technology. |

=> | Can Non-Resident Assessee declare lower profit? | Section 44BBD is a mandatory presumptive taxation scheme, assessee cannot opt to declare lower profits even if they have audited books of accounts. |

=> | Setoff of unabsorbed depreciation | Not allowed |

=> | Setoff of brought forward loss | Not allowed |

=> | Application of section 40(a)(i) / 40(a)(ia) / 40A(2) / 40A(3) | Not applicable since section 44BBD overrides section 28 to 43A. |

=> | Benefits | · Simplified Compliance reduces the need for maintaining detailed books of accounts. · Clarity on tax liabilities, aiding in financial planning and reducing disputes. · Encouragement for Foreign Participation in India’s electronics manufacturing sector. |

=> | Considerations and challenges | · Undefined terms like ‘services’ and ‘technology’ could lead to interpretational ambiguity. · Difficulty in determining taxable portions in composite contracts involving both goods and services. · Entities having unabsorbed depreciation or brought forward losses may find themselves at a disadvantage due to restrictions on offsetting these amounts against presumptive taxable income. |

1 “Government-notified schemes” refers to specific programs or policies approved and notified by the Ministry of Electronics and Information Technology (MeitY) or related authorities. These schemes typically provide incentives, subsidies, or frameworks aimed at boosting electronics manufacturing and innovation in India, such as:

- Production Linked Incentive (PLI) Scheme for large-scale electronics manufacturing.

- Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS).

- Electronics Manufacturing Clusters (EMC 2.0).

Entities eligible for taxation u/s 44BBD must be associated with resident Indian companies operating under these or similar officially notified schemes.